Unusual Option Activity in Value Stocks

Value Rotation at the start of April 2022

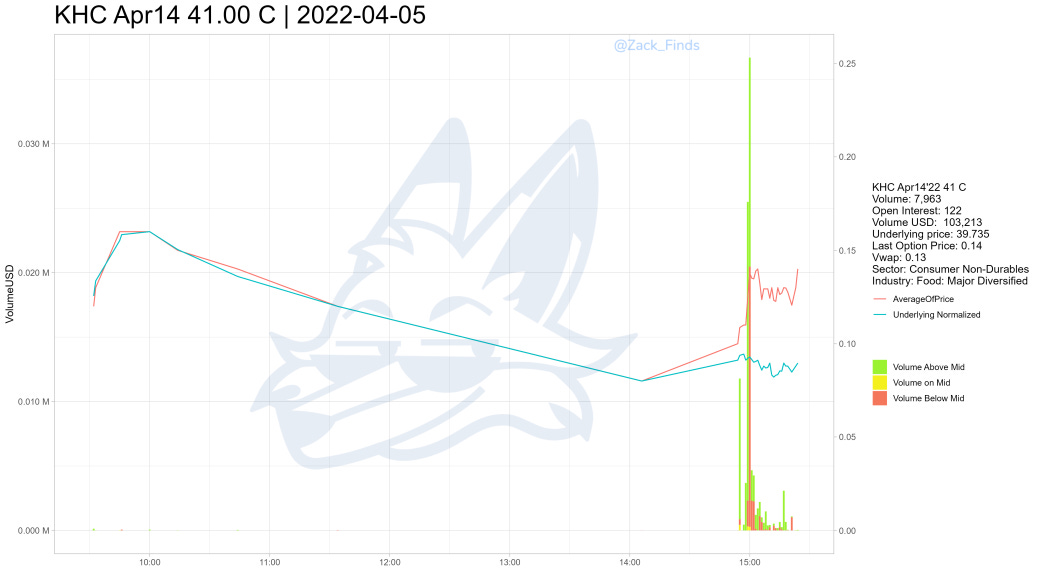

At the beginning of April 2022 ZackFinds.com detected several unusual option activity in Value Stocks with particular characteristics that pointed to significant bullish sentiment. Some of the activity we would like to highlight include options in The Kraft Heinz Company $KHC, Mondelez International, Inc. $MDLZ and Philip Morris International Inc. $PM.

The three companies mentioned above are all considered to be defensive dividend stocks that tend to outperform the S&P 500 during periods of economic uncertainty such as the present environment of geopolitical conflict, supply chain disruptions and rising interest rates.

Some points that we should highlight include the extreme Vol to OI ratios observed at the time the unusual activity was detected in the particular contracts we are referencing - 65.27x for KHC, 47.48x for MDLZ and 12.66x for PM.

Remember, the higher the Vol to OI ratio the higher the likelihood that the trades will lead to an increase in Open Interest reported the next day by the OCC. Additionally, these trades were not being registered as part of a multi-leg strategy.

In the charts above we can notice several similarities of unusual option activity - a sudden increase in volume coupled with a sustained (“sticky”) increase in IV even when the option volume starts to subside - this scenario may be interpreted as a situation where market markers are requiring a higher marginal price per new contract that is open due to their own book management risk profile. Considering that Market Makers need to hedge their risk, underlying liquidity will always be linked to hedging costs/risks and consequently these costs should and will be transfered and translated into option prices as an IV increase.

Additionally, this Unusual Transactions were strenghneting a case of Value Rotation - Defensive stocks have proven their worth and outperformed the S&P 500 by as much as 15 to 20 percentage points during periods of economic uncertainty over the past 20 years. Expectations of a more hawkish Fed have increased the risk that this economic cycle is shorter and accelerated a shift toward defensive stocks.

All these Options Expired with significant profits, with $PM Call reaching almost ~400% and expired with a 328% return; $KHC Call reached 914% and expired with 821% return while $MDLZ reached and expired with a 216% return.

Try it for free at ZackFinds.com

Follow the Smart Money