The Video Game Stocks Underperformed during the pandemic even as the number of players blew up with people under curfew. So what happened and why did the stocks underperformed? Most importantly, where might we go from here.

In this article I will try to pin-point some of the key factors that I believe are being understated and provide a great upside opportunity in the space.

CLOUD COMPUTING

Cloud Computing gained traction in March 2019 with google unveiling Stadia cloud streaming services, sending Sony shares plumming along with GameStop. Sony already had some presence in the space with “Playstation Now” – released in 2014 in NA, 2016 in the EU and 2017 in Japan. The service offered cloud gaming for mostly games that could be played on old generation consoles.

Additionally, and most likely the most prominent player in the space, Nvidia launched the Geforce Now streaming service in February of 2020. The game-streaming service by August 2022 had over 20 million registered users, up from over a million two years ago according to the CFO during an earnings call.

Games like Cyberpunk 2077 from Cd Projekt Red really highlighted the value proposition of these services. The game was not running well in the previous gen of consoles and would require expensive desktop computers to run. As the new generation of consoles from Sony and Microsoft were suffering from component shortages, many players, including myself, turned to cloud streaming.

So why is Cloud Computing relevant when analysing video game developers?

Substantially Lowers the price of entry for a potential customer and consequently increases market penetration, as the gamer no longer needs to spend high amounts of money to acquire the most recent console or PC. The gamer can now spend a substantially lower dollar amount in a subscription instead. Thus, the propension to spend more on video game titles increases.

In some in-development countries, where incomes are lower, cloud streaming may also broaden the potential market for games that require more powerful hardware and thus change consummer patterns.

Growth During the Pandemic

According to Bloomberg and PwC the video-game industry might have been one of the greatest beneficiaries of the pandemic, growing 45% in USD volume since 2019. However, it is important to add to this statement that 2020 and 2021 saw many Triple A games being delayed.

Total Global Video Game Revenue, by segment (US$Bn) (PwC Global Entertainment & Media Outlook 2022-2026)

Considering the importance of live services in Gaming - delays tend to be interpreted by market participants as extreme negative events. We have witness time and time again how delays affect stock performance - some examples include the Red Dead Redemption 2 and Battlefield 5.

However, the reason behind the delays may be strategic and not only related to development issues or constraints. During the pandemic, major video-game developers like Take Two Interactive, Electronic Arts and Activision Blizzard all saw top line growth when comparing 2021 to 2019.

Most importantly, reported operating margin were up, with $TTWO increasing from 7.56% in 2019 to 13.77% in 2020 and 18.76% in 2021; $ATVI increasing from 26.60% in 2019 to 26.80% in 2020 and 34.97% in 2021 while $EA increasing from 20.40% in 2019 to 26.19% in 2020 and decreasing to 18.58% in 2021.

As gaming sales in USD didn’t slow down and margins were increasing, there was no incentive associated with the launch of new multi-year development Triple AAA titles in a pandemic environment. Additionally, the production bottlenecks in new gen consoles were a suboptimal scenario regarding the installed based potential.

However, even as lockdowns boosted the overall number of people playing video games, video game developers had to adap development to a cenário of working from home. This posed unexpected creative challenges for people employed in the gaming industry, according to Harvard Business Review. Some gaming executives also expressed concerns regarding work from home - Previous CD Projekt Red CEO Marcin Iwiński said there were communication issues resulting from teams working that made Cyberpunk Development "painfull" at home while Take Two Interactive CEO, Strauss Zelnick, also admited, at the Morgan Stanley Media & Telecom Conference, that he isn't a proponent of remote-work himself, but he foresees the possibility of needing to allow personnel to stay home.

CD Projekt Red also shed light in their latest conference call insightful concerns regarding talent retention in an environment where local developers can easily work for companies across the globe with substantially higher pay - and thus potentially impacting operating margins and profitability.

Delays, Hardware Cycle & Market Perception

Major modern releases can take years and millions of dollars to develop, resulting in lengthy production schedules and occasionally, necessary delays. Hogwarts Legacy is one of the latest delays in a growing list of video games that have been pushed out of 2022's lineup into 2023.

In 2022 alone, according to IGN, there are 62 game delays so far. Some of the titles delayed include Dying Light 2 for Nintendo Switch, Suicide Squad: Kill the Justice League, OddBallers, Halo Infinite Co-op Campaign, EA Sports PGA Tour etc.

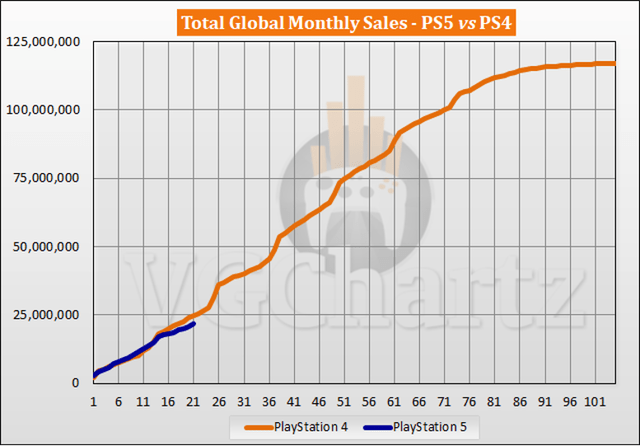

After 21 months, according to VGchartz, the PS5 is tracking behind the PS4 by an estimated 2.74 million units even considering significant supply constraints due to the global chip shortage.

PS4 vs PS5 sales cycle (VGchartz)

So far, the PS5 has been tracking well considering the production bottlenecks and chip shortage that we have mentioned before. However, discretionary spending and growing recession fears may negatively affect console spending and units sold going forward even as Sony sells the PS5 console at a loss since its launch last November. Console Business, since the PS4, pivoted from hardware margins to store fees and subscriptions like the PS Plus. These fees however, are expected to be pressured down, in major app stores - as major companies like Facebook and Epic have been vocal against appstore fees.

However, considering the importance of the user base size in new generation hardware installed base, there are strategic reasons for delaying titles. Monetization of existing titles is one of the reasons but also the importance of having a broad user base on the hardware for which the titles are being developed. It does not matter how good your game is if there is no hardware installed base is residual. The perfect example here is CyberPunk 2077 - as people could not experience the game as intended in available hardware.

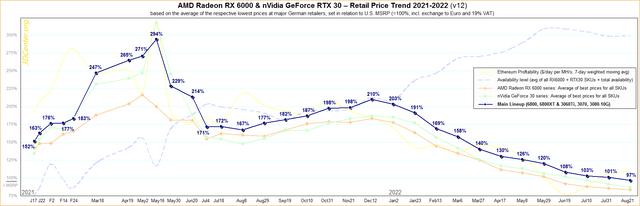

To wrap up this chapter, it is also important to mention GPU price trends. As it becomes clear that Nvidia and AMD are being hit by the crypto winter - with NVDA even being fined $5.5 Million for failing to acknowledge Crypto-Minersrelated revenues. Used GPUs are flooding the market as it's crypto related yield and use cases drop. Ethereum merging, increasing energy prices, regulation, recession fears, and overall crypto market cap substantial drop are, in my opinion, the main drivers associated with high end GPU price drops.

According to 3DCenter, the pricing for this core lineup has finally dropped under MSRP. AMD and NVDA GPU prices increased significantly during the pandemic but are now trending lower to levels below MSRP. INTC, in the other hand, by entering the market in the low-end GPU with its Arc line-up may be more resilient to the current environment.

AMD & NVIDIA GPU Pricing on August 22nd 2022,Source: 3DCenter (3Dcenter)

As mentioned before, considering the impact of the crypto market in GPU prices, I expect positive spillover effects in the gaming market associated with overall drops in High-end GPU prices. Again, as gamers spend less of the video game budget mix in hardware they will have a higher propension to spend in software, ceteris paribus.

Convexity, IP Development & Economies of Scale

It is also important to note, that the video game development industry also presents high convexity in terms of returns if a game sells significantly above expectations. As units sales and live-services come above expectativas operating margins will tend to expand substantially as development costs are diluted.

Additionally, asset libraries, engines and IPs may be reused and significantly accelerate development of sequels while releasing talent to work in new IP and expand pipeline - which does not immediately translate into operating profits but into unnanounced titles in which investors have limited visibility.

World of Warcraft 3d Models (MMO-Champion)

In order to share a small example - above I share two models used in World of Warcraft. The 3d model on the right uses an animation and texture from the classic game released in 2004 while on the left uses the same animation with a different texture but released in 2020.

Conclusion

Even though video game developer stocks have been underperforming the market during the pandemic I believe several factors are being underestimated by the market:

Cloud Streaming and GPU prices coming down - lowering entry costs for gamers and potentially changing gaming patterns;

Next Gen user base growth - should put a stop on the delaying titles trend for strategic reasons;

Digital Store fees will eventually be pressured down and may eventually force owners such as Apple to move into video games;

Lack of pipeline visibility and high economies of scale makes it very hard for analysts to model with accuracy, particularly for smaller video game developers like CD Projekt Red;Relatively Cheap Entertainment - when compared to alternatives video game as entertainment is cheap and should hold well even as discretionary spending is hit.

In the next article we will highlight the list of acquisitions made by the mega caps to enter the space.